Do you remember the days when taking pictures with a camera, getting them developed, and putting them in a photo album was the norm?

Today, things have changed, and you can store years of memories in your pocket. In many cases, physical assets don’t hold as much sentimental value as they once did, as everything can be backed up digitally.

We have mass storage spaces online that back up our digital files, sometimes automatically. This creates a sense of security, as a lot of our digital life has become very important to us.

With all this in mind, it’s interesting how some people haven’t thought about what happens to their digital life when they die. Pictures and videos are one thing, but there’s other things to consider that are usually password protected, and might be hard for someone to access if you weren’t here anymore.

Having a plan for what happens to your digital assets outlined in your Will, can make things easier for your loved ones. But first, let’s cover what digital assets actually are.

What are Digital Assets?

Digital assets are things created and stored digitally that provide some level of value. There are many different types of assets that could come under this umbrella term, these include but are not limited to:

- Photos or videos

- Audio or music

- Social media accounts

- Email or IM accounts

- Documents

- Word documents, spreadsheets, or presentations

- Websites or domains

- Cryptocurrency and tokens

As the continuous integration of our physical and digital life becomes deeper, so does the importance of creating a plan for what happens to your digital assets when you die.

Should I Include Instructions for my Digital Assets in my Will?

If you want your loved ones to know about your digital accounts and how to access them, yes. It’s good practice to keep an up-to-date list of all your accounts and usernames, however it may be against some platforms’ terms and conditions to include the passwords.

If you’re writing a Will and have chosen someone to be the executor who doesn’t have a lot of digital experience, it is possible to appoint a digital executor. This person will be responsible for dealing with your digital assets, and may not need to get extra help in doing so as they have the relevant knowledge or experience.

If you don’t include your digital assets in your Will, they will be included in something called the residue of the estate. The residue of the estate is whatever is left over when all the wishes outlined in the Will have been fulfilled, and whatever’s left over will be distributed in accordance to what is outlined in the Will. However, without instructions and a list of accounts, this might not be useful to your loved ones.

Managing your digital assets and including them in your Will, can save people a lot of trouble if they need to assess your online accounts.

What if I Don’t Leave a Will?

There are many reasons that it is highly advised that you leave a Will.

The probate process is difficult enough to manage when a Will is in place, so not writing one can leave your loved ones in a difficult position. But exactly what happens to your digital assets if you don’t leave a Will?

Similarly to your other assets, if you don’t leave a Will, things will be distributed in accordance to the rules of intestacy, which is a predetermined order which people inherit from. However, this does not take into consideration your wishes.

If you’re the only person who has access to an account that has family photos in it, for example, it might become impossible to gain access to it. In some circumstances, this could mean precious family memories are lost forever.

This is why it’s important to have your wishes written down in a legal document. This allows you to leave instructions when you can’t speak for yourself anymore.

Tips for Managing Your Digital Assets

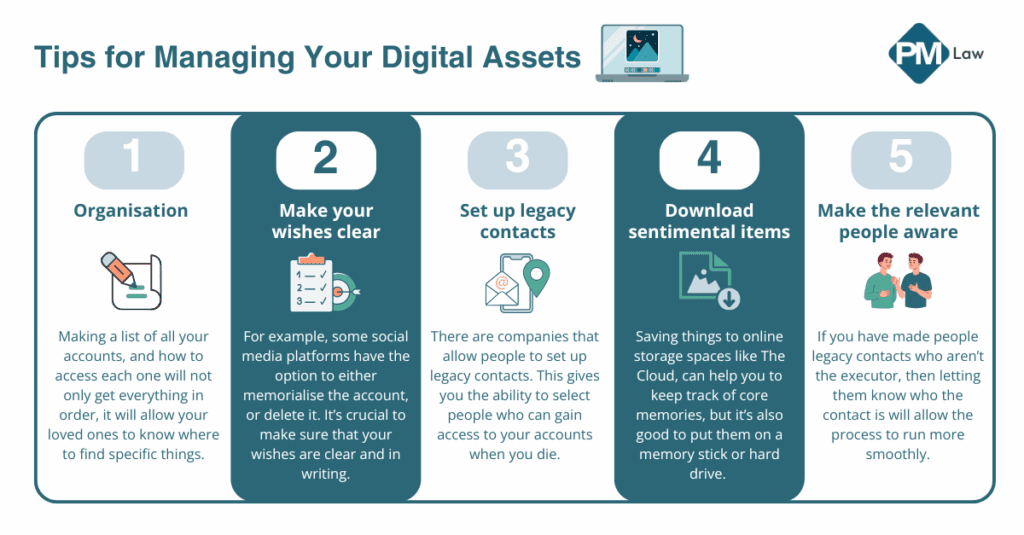

Having an idea of how to manage your digital assets can allow you to prepare. Here are some tips to get you started:

Organisation – Organising your digital assets is a good way to get a clear idea of how many accounts, assets, and platforms you use. Making a list of all your accounts, and how to access each one will not only get everything in order, it will allow your loved ones to know where to find specific things. It’s important to include the email address associated with the accounts, and any additional information that will make gaining access easier.

It’s important to note that writing down your passwords may be against the terms and conditions of the companies, but many have options should someone pass away and their loved one requires access. This depends on the platform, device and company.

Make your wishes clear – Leaving clear instructions will eliminate room for assumption. For example, some social media platforms have the option to either memorialise the account, or delete it. It’s crucial to make sure that your wishes are clear and in writing, that way your loved ones will know exactly what to do.

Set up legacy contacts – There are companies that allow people to set up legacy contacts. This gives you the ability to select people who can gain access to your accounts when you die. Apple, for example, has recently given people the ability to set up legacy contacts, which allows you to set up a contact who can gain access to the data in your Apple account after you die. Both Google and Facebook also have the option to set up a trusted individual to be able to access your account.

Download sentimental items regularly – This is good practice anyway, but making sure your online memories are downloaded and backed up will allow you to keep track of where everything is. Saving things to online storage spaces like The Cloud, can help you to keep track of core memories, but sometimes it’s also good to have them downloaded to a memory stick or hard drive. That way they’ll be easy to access and act as an extra layer of security should your loved ones have any trouble accessing your online accounts.

Make the relevant people aware – Let the executor of the Will know what you have planned. For example, if you have made people legacy contacts who aren’t the executor, then letting them know who the contact is will allow the process to run more smoothly. It may also be worth letting any of the beneficiaries know what your plans are.

There are of course, many other factors to consider when we’re planning for what happens to our estate when we die, which is why getting legal advice is the best way to get started.

How we Can Help

Writing a Will can save your loved ones a lot of trouble, and allow your wishes to be fulfilled when you’re not here anymore. In this day and age, you may hold more digital assets than you think. A lot of your digital activity may have become second nature, meaning you don’t always consider how much you rely on your digital life.

This is why having a plan for your digital assets and accounts can give you peace of mind, and allow your loved one access to things that may hold a lot of significance to them too.

At PM Law, we like to make sure everything is in order for you and your loved ones. Writing a Will and keeping things up to date is a great way to ensure that security. Get in touch with our Wills, Trusts, and Probate team today, and we’ll help in any way we can.