When you’re dealing with the complex law of probate, alongside the death of a loved one, things can feel overwhelming. There’s many rules and regulations surrounding inheritance that you may have never even considered before. One of these is paying Inheritance Tax. You may be left wondering whether you need to pay it, how much you need to pay, and when you need to pay it. It’s a lot to get your head around, but we can help.

One of the ways to make sure you’re acting within the confines of the law is to have a team of legal professionals behind you that support you every step of the way. Our wills, trusts and probate team are here to support you, and answer any questions you may have.

For now, let’s start with the basics.

What is Inheritance Tax?

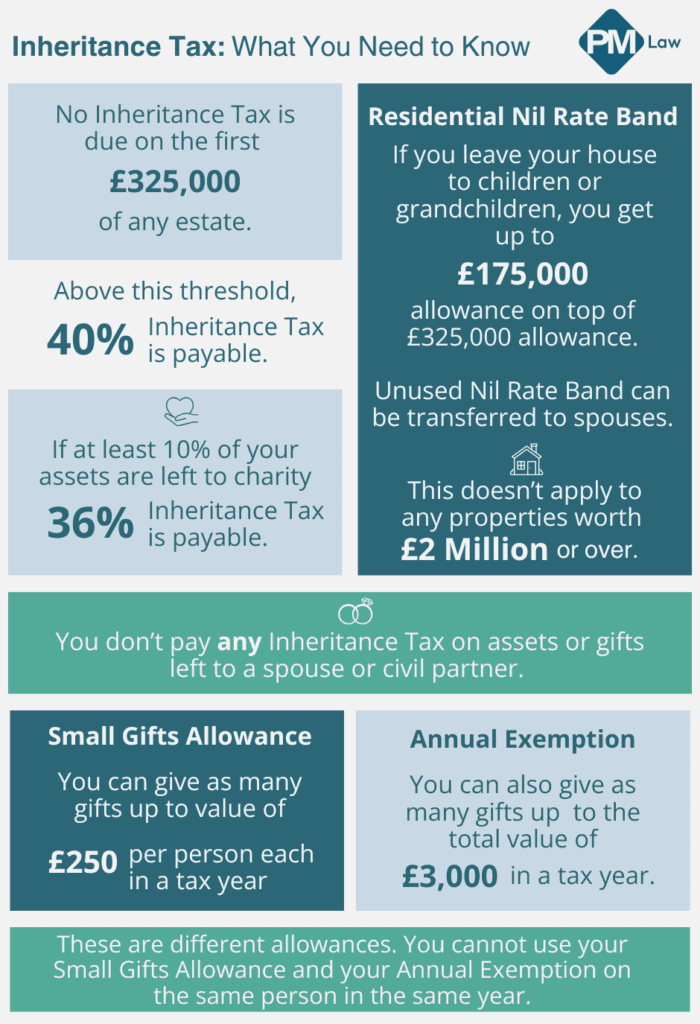

In short, Inheritance Tax is a type of tax you pay if someone dies, and the amount they leave behind is over a certain amount. In other words, if someone’s estate (money, assets, possessions) is over the tax-free amount or nil-rate band (NRB), the person dealing with the distribution of the estate will have to pay tax of 40% on the amount over the NRB.

Currently, the inheritance tax NRB is capped at £325,000. This means anything over that amount will be taxed.

For example, if an estate was worth £600,000, the tax due would be on the amount over £325,000. That means the tax due would be 40% of £275,000, which is £110,000.

However, the amount of Inheritance Tax that is paid can differ due to a few different circumstances. In the first instance, valuing the estate will give someone a good idea of what to expect.

Valuing an Estate

In order to know how much Inheritance Tax (if any) is due, there must be an estimate of the value of the estate. This includes any debts, assets, property, possessions and money. Once there’s an estimate of this, the amount of Inheritance Tax can be calculated. In most cases, this needs to be paid before the probate process can start, which is the distribution of someone’s estate. This is a big responsibility as beneficiaries will only be given their share at the end of the process.

The person responsible for valuing the estate and paying Inheritance Tax will depend on whether or not someone has left a will. If there is a will, valuing the estate will be the responsibility of the executor, who will be named in the will. If there’s no will, this will be the responsibility of the administrator, who will need to be appointed. Once the value of the estate has been estimated, it needs to be reported to HMRC if the estate is taxable.

The Inheritance Tax must be paid, or at least start being paid within six months of the person’s death. If it isn’t, interest will be charged on top of the initial payment. Inheritance Tax liability can be transferred directly from a deceased person’s nominated bank. If there are insufficient funds, the executors can take out an executor loan. Alternatively, they can apply to pay liability back in instalments, but this is normally just on property, not other assets.

When it comes to dealing with someone’s estate, the sooner the process of valuing their estate is started, the better. This gives everyone involved the chance to get to grips with the logistics, which is crucial if it’s a large or complex estate.

How Much Inheritance Tax Do You Pay?

The amount of Inheritance Tax someone pays is dependent on a few factors, mainly the value of the estate. However, there are other variables, such as what is being passed on, and to whom.

We’ve put together this infographic to give you an idea of some of the most important factors when it comes to paying Inheritance Tax:

Small gifts can only be given once to an individual in a tax year. If the same person received this more than once, it is taxable. The same person cannot receive the £3,000 and £250 in the same year.

With all of this in mind, there are some circumstances and situations where there is tax relief and exemptions.

Inheritance Tax Relief and Exemptions

When it comes to Inheritance Tax relief and exemptions, things can get complicated. It’s advised to get legal advice to make sure you’re acting within the constraints of the law during the probate process, or that your will has taken Inheritance Tax into consideration for the beneficiaries.

With that in mind, some of the main exemptions include, but are not limited to:

- Spouse or Civil Partner Exemption – Even if the estate is over £325,000, if it is left to a spouse or civil partner it is exempt from inheritance tax. It’s worth noting, that if no will is left and the deceased is unmarried, according to the rules of intestacy, the surviving partner isn’t legally entitled to anything. This can lead to disputes and contesting probate, which can be incredibly stressful. That’s why leaving a will is so important.

- Charity Donations – If the estate, or a portion of it, is left to a registered charity, it is exempt from Inheritance Tax. On top of this, if the deceased leaves at least 10% of their estate to charity, the rate above £325,000 is reduced from 40% to 36%, offering 4% relief on the taxable amount of the estate.

- Gifts – Gifts up to a certain amount can be given a year without being taxed, as long the person gifting the money survives for seven years after the gift was given. People are allowed to give away up to £3,000 a year, and this can be carried for one year. This means if the £3,000 exemption wasn’t utilised one year, £6000 could be given the year after. On top of this, people can also give gifts in connection to a marriage or civil partnership before the ceremony takes place without being taxed.

Parents can give up to £5,000.

Grandparents can give up to £2,500.

Others can give up to £1,000.

- Business Relief – Passing on a family business or farm can result in not paying Inheritance Tax. There can also be relief if shares, or business assets are passed on, but this is reduced by 50% rather than 100% depending on the circumstances. The business must have been active for at least two years before the owner of the business dies, and each business is subject to specific criteria. It’s important not to assume a business is exempt and make sure it meets the criteria.

Currently, there is no upper ceiling on relief of this type that qualifies for 100% BPR or APR. However, from 6 April 2026, relief at 100% will only be available for the first £1 million of combined agricultural and business assets. Anything over this amount will only attract relief at 50%. The £1 million allowance will be applied proportionately across the qualifying property. Assets currently only qualifying for 50% APR or BPR will not use up the £1 million allowance. If any of the allowance is unused it will not be transferrable between spouses and civil partners.

With the uniqueness of every estate, and the many factors that affect Inheritance Tax, it’s vital that people get the correct legal advice to avoid paying interest on top of what they already owe.

At PM Law, we understand that this area of the law is sensitive and needs to be dealt with in the appropriate manner. In the midst of dealing with the grief of losing a loved one, as well as handling their estate, paying Inheritance Tax may feel trivial.

However, it is something that can cause a lot of hassle and prolong the probate process. This can cause problems during an already emotionally demanding time, especially if people are relying on their inheritance.

We want to help in any way we can. We understand that this area of the law is complicated and confusing. Our goal is to simplify the process and deal with the legal side of things, so you can focus on everything else. Contact us today, and see how we can help you.

*In the April 2024 Autumn Budget, Chancellor Rachel Reeves announced that from April 6th 2027, unused pension savings may be included in your estate for IHT purposes. Currently unused pensions are typically IHT free. Under the new changes, unused pensions could be taxed if your estate exceeds the threshold.